Capri - A Reverse Merger Arb

Quick Update and Rebranding

Apologies to the subscribers for the gap in content. Past year has been a bit of a whirlwind and as I’ve settled down I want to create more regular content (well as much as reasonably insightful research will allow). Some names are lower liquidity that are worked on with other funds which can cause a delay in publishing as the funds need to position-sized fully. Given that, I’ll aim to work up a backlog of actionable ideas so you’re not waiting months (or a year).

As a part of coming back, thought it would be worthwhile to rebrand to Xiao Capital and have less of a whimsical tone to the blog itself. I know, so creative like the rest of the finance world…

Capri / Tapestry vs FTC

I am short CPRI on likely antitrust action by the FTC and see a 45% downside.

CPRI is a fashion house that owns Michael Kors, Versace, and Jimmy Choo that is currently going through an acquisition by Tapestry, another fashion house that owns Coach, Kate Spade, and Stuart Weitzman. The merger was announced in August 2023 and is currently going through a second request by the FTC that was initiated in November. On the surface, there seems to be little antitrust issues but taking a deeper dive it becomes clear that Capri and Tapestry both own a significant market share in the affordable luxury market, the likely reason behind the anti-trust concerns.

There are very few remedies that can be actioned as it would involve divesting either Michael Kors or Coach and would go against the industrial logic of the deal. On top of this, Capri’s fundamentals have been deteriorating with Q ended December results showing -6.6% YoY CC rev declines and is now trading at 11x NTM P/E vs 6x before as well as showing multiple quarters of declines. A likely break price is around its previous trading multiple and would point to a share price around $25 for a 45% downside. Even accounting for the performance of peers, who have had arguably better operations, the break price goes up marginally to ~$28. Upside risk is capped at the deal going through at $57 and represents a 22% upside risk. Essentially, the deal is pricing in 33% of failure where I believe it’s likely higher and more likely in the 70% range given historical merger records.

Antitrust concerns

The DOJ has ratcheted up its antitrust oversight and has become increasingly aggressive in its merger targeting. This can be seen in the recent Spirit / JetBlue and Amazon / iRobot deals along with it chasing to block the Blizzard / Activision deal. The more aggressive stance can also be seen in the recent 2023 merger guidelines which point to much more aggressive policies and a roll back to tighter definitions from prior guidelines.

Tapestry likes to define its market as the 200B luxury goods market, and this market is definitely overly broad by antitrust definitions. It is likely the market is being viewed by the FTC as the affordable luxury bags market. The standard test by the Agencies to test relevant markets is the hypothetical monopolist test. This test examines if in a narrow market, whether a monopolist would make more by raising prices significantly (usually 5%). When placed under the hypothetical monopolist test, the affordable luxury market can been seen as an individual market as price actions by the affordable / accessible luxury bags market is entirely ignored by the high fashion houses (Chanel, Hermes, LV, etc.).

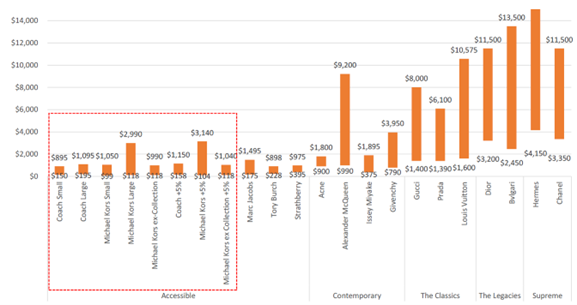

This tiering in price is significant and defensible as clearly seen in Figure 1, TPR and CPR both do not have brands that are sold within the same tiers as high end luxury brands and any price increases will largely effect competition within the affordable segment, and specifically between Kors and Coach which are the largest handbag brands in the category in North America.

Figure 1: Range of Online Handbag Pricing by Brand

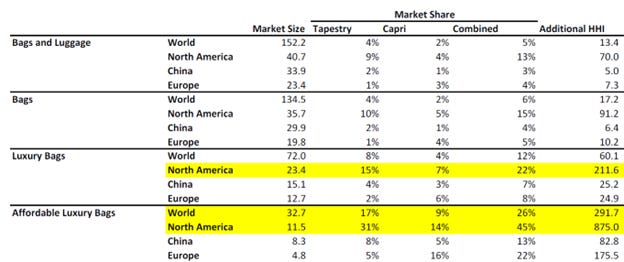

This high market share also results in a high diversion ratio and with high gross margins and a high General Upward Pricing Pressure Index (GUPPI) test. By my estimates, Tapestry (31%) and Capri (14%) would combine to have a 45% share. (We note some accessories are included in the bags definition as the companies do not have a complete break down of bags. Excluding the entirety of the accessories segment would still result in significant share for TPR, CPRI, and CombineCo).

Figure 2:Capri and Tapestry Market Share by Segment | Source: Euromonitor

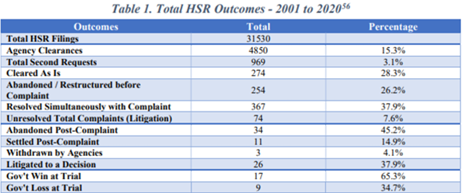

The likelihood of an injunction is raised with the recent second request. Sometimes if the Agencies are too busy, a merger that would not live up to scrutiny would still be able to pass. However, historically, only 2% of transactions have a second request with 29% of those transactions being cleared as is or being won at trial. Of the remainder, 26% are completely abandoned with the rest having some sort of settlement or remedy to pass. Given there is limited likelihood of any remedy given the industrial logic of the transaction with the largest 2 brands, the probabilities of the deal passing are closer to 30%. With $25 as the break price, the expect value would be $34 vs the $45 it is trading at today and knowing the specifics of the deal and the extent of the combined market shares, it’s likely to be even lower.

Figure 3: Historical Merger Outcomes

Capri as a Brand

Michael Kors history is well known as a brand that started out in luxury but has discounted its brand equity away. Kors, which accounts for 68% of total revenue, discounts over 50% (sometimes up to 90%) of its goods all year round with price cuts of about 50% (so the half off you see is not really a deal). Comparatively, Tapestry’s Coach discounts seasonally with periods where <10% of its products are discounted to periods of ~50%. Kors’ high discounting window shows a level of desperation to generate sales and a difficulty for the brand to pull back on promotions in any period as have consumers developed a habit for sales periods.

Capri has stopped participating in earnings calls and engaging with investors after the transaction announcement. On its most recent quarters it has seen continued declines across all its brands and as a group is still performing below pre-COVID levels. There is no reason to believe the trend will reverse with most consumers having negative feedback on Kors as a brand vs competitors. Although the pre-transaction valuation was low, it was deserved, with the poor recent performance, no clear signs of recovery, and a challenging competitive / macro environment.

As always, we recommend you do your own diligence

Edward, what's up with the substack?