I’ve spent some time recently trying to wrap my head around the semiconductor space. If there was one industry that doesn’t follow traditional investing norms, this is probably the best example. Investors are quite forward-looking and the businesses trade on much more leading supply demand indicators than traditional industries. It doesn’t take anything more than looking at the memory players not trading down at all while having negative 30%+ gross margins to show you that these blips are well understood and overlooked (although with good trading opportunities).

Semis have become sexy in the investor community, and nothing could more evidence that than the rise in semi analysts hiring at large funds as funds look at the astounding returns from names like Nvidia. Thinking about where the future can go and digging deeper into the AI, it’s clear that the hardware picks and shovels play offers one of the better ways to get exposure in the industry as application solutions don’t yet have clear business models. Previously a normally growing industry due to the investments in datacenters and IT generally has inflected massively as AI spending is ramping from price agnostic hyperscalers. Nvidia and the general GPU theme is well understood at this point with Nvidia seemly to be fairly valued in the absence of another leg of acceleration. Nvidia also faces risks as companies moving onto the next generation of chips can begin to choose to design their own custom silicon (ASICs) solutions to avoid the hefty Nvidia mark ups.

What isn’t as customer facing is in the connectivity space. Specifically, the front and back-end connections within datacenters are the nuts and bolts of datacenter operations. Connectivity is important because the limiting factor on AI training has become the transfer of AI models and model weights to the GPUs to do calculations. This is why memory has become so important on GPUs with large HBM sizes needed to store and quickly access the large models and then move the resulting calculations around.

There is no monopoly in the connectivity space with many players getting designed into various datacenters. One of these companies is Alphawave Semi which IPO’d in 2021 and then faced several setbacks in terms of China, a scathing news article, and accounting mishaps. The business has now rightsized itself and trades at a sizeable discount to AI connectivity peers such as Credo and Astera Labs and the larger custom silicon players such as Marvell and Broadcom.

Alphawave has guided to $1B in revenues by 2027 and an interim $450mm target in 2025. These guides are founded on existing design wins and experience with prior wins, and such are subject to change but serve as relatively solid guideposts. The company has also guided to 30%+ margins which at the current valuation would signal the business is trading at 3.3x 2027 EBIT. This guide isn’t heroic given one product win with one hyperscaler signing can be $100+mm in annual revenue and they already have one product near completion with Amazon by the end of the year that to our knowledge is progressing smoothly. It is likely that Alphawave will be a much stronger business by 2027 and we can see the business easily trading to 30x on ’27 numbers in ‘25/26 if the business can pull off its targets and there is enough foresight by the market in either design wins or rumors. As such we see a potential YE2026 10.2x / 142% IRR upside in the world where Alphawave succeeds and a 1.5x / 17% downside if it’s unable to have ANY custom silicon wins.

The asymmetric return profile makes Alphawave one of the most exciting names in our portfolio as compared to early-stage peers, the Company has a solid foundation. We also see a potential pair trade in CRDO or ALAB to hedge overall AI hype exposure. Even though CRDO and ALAB don’t enjoy monopoly status, they have caught on to AI investors and have been bid up due to design wins in existing hyperscaler roadmaps.

Alphawave

Alphawave was previously an IP design house that focuses on connectivity technology. With their acquisition of OpenFive and Banais, they now have a complete spectrum of connectivity offerings of IP licensing, custom silicon, and connectivity products.

Putting this in layman’s terms, the company offers knowhow on networking between chips and datacenters and is able to license this know how in the form of IP with its over 235 IP portfolio. The company also formed partnerships with ARM and after the OpenFive acquisition expanded other areas of its design team to create more custom silicon solutions. Alphawave can then leverage its custom silicon products design knowhow and develop more generalized merchant chips that it can sell off the shelf.

Customers use these products to varying degrees based on the customer’s in-house knowledge of semi design. The biggest benefit of these design houses is it greatly accelerates time to market as instead of starting from scratch you have a readymade template that you can commission Alphawave to reconfigure to better suit your needs.

Alphawave’s legacy comes from a team of serial entrepreneurs. Starting from Snowbush, and then to V Semiconductors which was acquired by Intel in 2012. the founding team was heading up Intel’s connectivity solutions until Alphawave’s founding in 2017. The Company is well regarded within the industry with TSMC OIP partner of the year wins for 2020-2023 (its first product was in 2020) and already has IP within all the large hyperscalers.

This is even more impressive in the context that Alphawave was founded in 2017 and essentially bootstrapped their way with limited financing (founders still retain 42% of the business). Funding was created through innovative deals and agreements which are now in the rearview mirror but caused some related party accusations. When the business started, very few people believed that the company had any chance of success given existing behemoths like Cadence and Synposys. One year after the company started selling products, rumors are that Cadence’s board had an emergency weekend meeting to discuss how they lost a whole market to Alphawave. The team has since continued to innovate and moved rapidly into custom silicon and chiplets, all at the leading edge.

This perception of prestige and competence is extremely important to hyperscalers as the connectivity solutions can be as much as 33-40% of a chips power budget, a major bottlenecking component in recent semi development. One of these components are Serializer Deserializers (SerDes) which essentially takes multiple data lines to one line and vice versa to optimize data traffic. These technologies are often considered a black art within Semiconductors given the complex nature of optimizing analog signals and recalibrating distortions between signals. It is extremely complex, and the number of analog experts continue to shrink as companies try to solve problems through digital chip designs.

Although the company has very few custom silicon sales today, its stated goal is to become a mini-Marvell or Broadcom. This is interesting given Sehat Sutardja’s current 13% ownership in the firm as Sehat was a cofounder of Marvell and has been supportive of Alphawave since IPO. Sehat continuously bought more of the company post IPO and I believe his presence on the board is very positive given he essentially started the same business when he founded Marvell in 1995.

The customer life cycle is long and goes through an initial engagement phase, design phase where Alphawave earns Non-Recurring Engineering revenue (NRE), and a product phase where Alphawave earns a royalty over the life of the product or gets outright payment. The product phase is usually a long phase and could stretch to a decade in infrastructure and datacenter design wins. These wins also secure future wins as it helps the design firms to leverage partnership data to work together more easily. As such, a lot of diligence is done initially on the partner to ensure that they can be relied upon to work on products further down the road map, this is especially the case in connectivity as it’s like the nervous system of a chip and ripping it out can be extremely painful requiring significant redesign. Given the required confidence from customers, Alphawave’s impressive roster of IP and current development partners gives me assurance the technology is high quality.

Amazon Contract and Relationship

All the custom silicon projects are in the early stages but we are encouraged by early feedback on the large $300 million non-binding Amazon agreement that Alphawave disclosed. The agreement is focused on a datacenter interconnect project that leverages Banias’ optical coherent technology. The reality is that they are in talks with Amazon to make the agreement much larger and it can range up to $700mm (from IR). This would just be one of the first engagements and as a company wins more designs, it is likely to beget further design wins.

The non-binding portion is also more secure than most non-binding agreements would have you believe. Talking with IR on why they decided to acquire Banias after the IPO instead of beforehand, IR responded “We were more or less encouraged by a large customer to make the acquisition. The customer wanted to be less reliant on Broadcom and the acquisition allowed us to expand our product portfolio.” This is supported by several news articles and the close relationship with the largest hyperscaler deems that there are likely more product purchases between the two.

Currently tests are going well and recent confirmation from an AWS employee confirms as such:

Listen, when the product underperforms or performs way below the metrics, the testing stop. So the fact that we're testing is because the product is working… Yes, because the metrics need to be stable. And in order for the metrics to be stable, we need at least six months of data. So my guess is that if a purchase order comes in, it's going to be in August, September.

– Head of Cloud Strategy at AWS Financial Services

We see a high chance of success with Amazon that will likely lead to further hyperscaler wins and results will likely appear in Q3 2024.

Technology and Competition

The explosion in networking and connectivity from AI is massive. As model sizes have gotten larger, there is more need to simply store the model and move it between different chips to train it. Marvell explained networking best during their AI day:

“In the past, Internet applications would be based on software broken down into micro services that would fit within the confines of a single processor and it's memory. But with AI, you need to distribute the workload across multiple elements and then rely on the network to make those processors behave like a single component. This obviously requires a network with higher capacity and predictable latency because application performance is directly correlated to network performance.”

- Marvell Accelerated Infrastructure For The AI Era Event

This networking performance is driving massive increases in TAM with categories like custom compute likely to experience a 45% CAGR over 5 years. Note, for all the categories highlighted by Marvell, AWE also hold key IP for, and would simply require low single digit market share to meet its 2027 targets. AWE is also leading edge which has higher exposure to the accelerating AI demand.

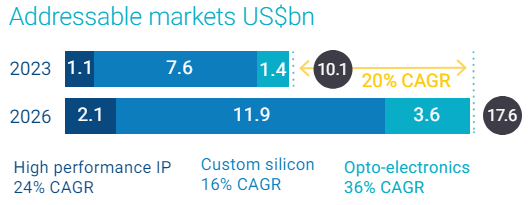

AWE has more modest estimates which is due to the less integrated nature of selling complete products (aside from custom silicon). AWE expected a 20% CAGR and would still have only a single digit market share if it reaches its 2027 targets. However, in the last trading update an updated projection actually put custom silicon at a $30B TAM in 2027 and would point to a 52% CAGR TAM estimate.

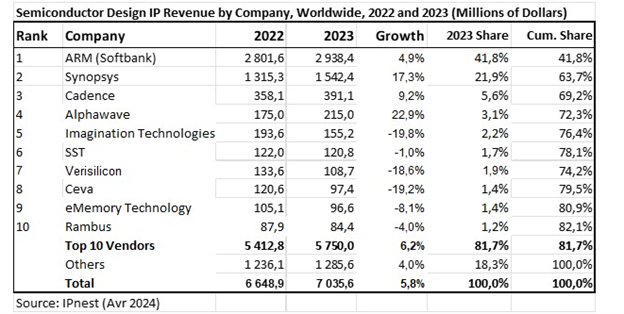

For the design IP space specifically, Alphawave has been one of the fastest growers although it only focuses on the connectivity niche landing in the top 4. The business grew to become a major competitor to Synopsys and Cadence in just 2 years since it started producing and licensing their IP, a truly impressive feat and all done while focusing on interconnect.

This growth is unlikely to slow down with high end interfaces seeing further design starts and is expected to have far higher growth than the broader market. IPnest estimates that the high-end interconnect IP market will grow at a 40% CAGR from 2021-2026 (but 20% CAGR 2022-2026) off of greater need for connectivity bandwidth and multi-die systems. This estimate was made before the recent boom in AI and rapid growth in data center and AI spending that we’re seeing today.

The company’s technology remain market leading with tapeouts for next-generation 224G, PCI Express Gen6, HBM3, and UCIe interface IP in 5nm and 4nm. The commitment to R&D is further visible through its employee base which is 90% R&D focused as there is minimal market spend and a 7% turnover.

Chiplet Architecture

Chiplets are essentially Lego pieces which can be used to piece together a larger chip. The main benefit comes from yield improvements as statistically there is less surface area for defects on a smaller chiplet and have that simply connect to other chiplets (average yield of 80% on 150mm2 whereas 30% yield on 700mm2). There are also benefits of reducing costs from large features that don’t benefit from smaller nodes such as I/O functions and can lower costs. Overall, its estimated that there is ~13% net savings from chiplet architecture.

Why is this important for Alphawave? Alphawave benefits in two ways from chiplets, (i) Alphwave can provide the chiplet-to-chiplet (D2D) IP and has been a contributing member of the Universal Chiplet Interconnect Express Consortium, and (ii) Alphawave can build and sell custom connectivity chiplets that adds extra margin dollars versus simply selling its IP which also better addresses its customer’s needs. As seen in the above market projections, Die-to-die (D2D) interconnect is expected to CAGR at 72% and it is worth highlighting separately as it can actually be much higher.

Management and Team

Alphawave has come back with some of the highest quality diligence checks and feedback from the industry. The three founders all still hold 13% of the business and when asked why they aren’t buying shares if they think the business is undervalued, they replied that they were restricted by LSE regulations because they are views as a controlling body along with Sehat Sutardja.

Some sample quotes from experts are below:

Frankly, when a Tony Pialis in compared to Elon Musk… He has a team that he can lead into success.

– Former SVP at Alphawave

“And Alphawave is very much a company full of some very smart people with great industry expertise that are, I would say, thought leaders. I love it when I get on the phone with them there. They tend to reframe problems through some pretty innovative questions like, "Hey, rather than thinking about dissipating the heat, what if we were to look at like underlying energy consumption and stuff like that, that's causing heat?” So they're very good about, yes, problem solving. And I will say, I would like to work with them on some more projects.”

– Chief Architect at Microsoft

“But if you look at the company, the leadership for optical transceivers, optical interconnects, Alphawave. Alphawave.”

– Consultant in Semiconductors

At times, these mentions come across unprompted and show that the company is very well regarded in the industry.

Financials, Guidance, and Valuations

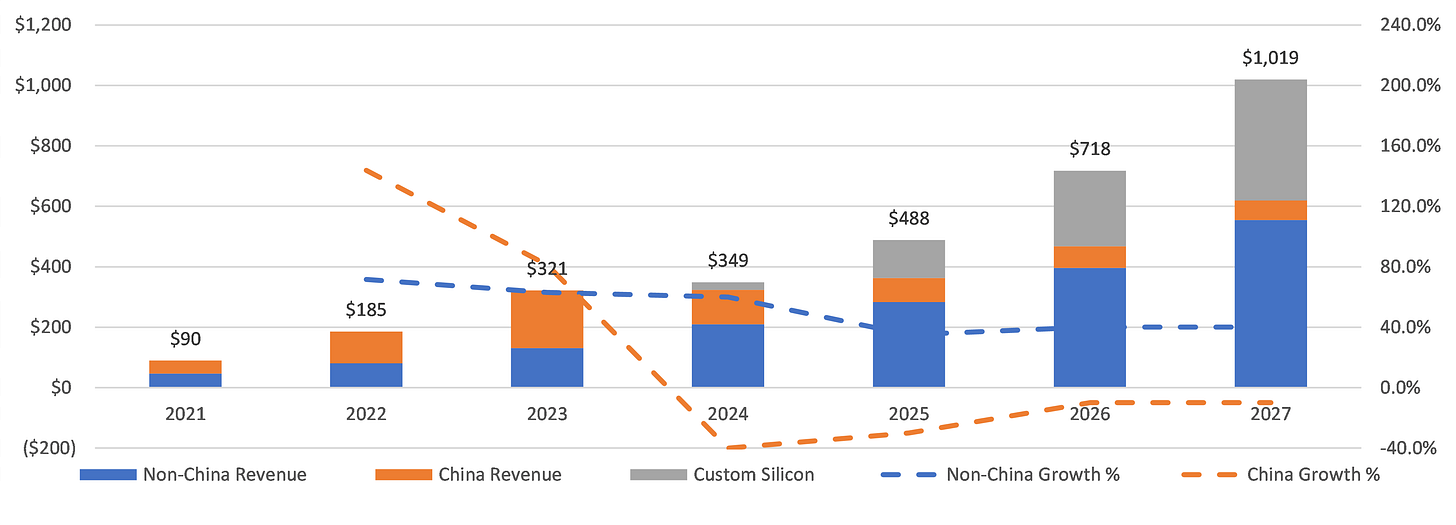

Management recently brought down guidance (2025 revenue from $500mm to $450mm) as they choose to exit the China business and due to changes to how they recognize some revenue from their bookings and OpenFive acquisition. The decision to exit China makes sense as it will be difficult to provide leading edge technology when the country is limited to 7nm and above nodes with US sanctions in place. The revenue recognition is an unfortunate event as the business has struggled with its financial disclosures in the past which the market has not been kind to.

All this causes revenues and bookings to optically look weak, but as can be seen below, Alphawave can still handedly meet 2027 targets with the custom silicon ramp that they’re focusing the bulk of their efforts on. The massive declines in China cause revenue to flat line in 2024 but the effects fade quickly in 2024 as it drops by 40%. With non-China revenue slowing to market level of ~40% growth and China revenue shrinking every year to 2027, custom silicon needs to be ~$400 business by 2027.

The Custom silicon ramp is not heroic. There is line of sight into the Amazon custom silicon deal of $100-$200 million per year which is expected to go into production around Q3 2024. Alphawave is already in development with 2 other customers (One hyperscaler that is likely MSFT and one Networking OEM) for chunky custom silicon orders which provides line of sight into additional customer silicon revenue. AWE only needs 1-2 of these large custom silicon deals per year to add $100 million revenue per year into the custom silicon business (they already have 2 in the pipeline).

This is all in the context if AWE grows at market rates when they have shown the ability to go far above that and has been consistently named by industry participants as one of the leading players and strongest teams. I can see further upside to these estimates which is supported by the hiring they’re doing with currently 70 open job positions of which 27 were posted in the last 30 days off a base of 800 employees implying a 10% increase per quarter in employees (~9% if you include the 7% per year attrition).

What does this mean for the valuation and guide? Alphawave currently trades at 3x 2024 Sales, 1.1x 2027 sales, and 3.3x EV/EBIT. This valuation alone screams cheap but it’s in the context of its peers that makes it even more outrageous.

Cadence and Synopsys are EDA provides which hinders the comparability but have large IP portfolios. CRDO and ALAB are considered major AI beneficiaries that serve the networking and connectivity market (CRDO for cables and ALAB for retimers). I have separate views on CRDO and ALAB which could serve as interesting pair trades but that’s for another post. ALAB and CRDO are currently trading massive valuations at 90.6x and 27.4x 2025 EBIT, respectively.

I don’t believe AWE growth will slow in 2027 and at that point the business will be designed into more customers and have a more diverse set of products. Applying a market 30x EBIT forward multiple seems reasonable and that means by YE 2026, Alphawave would have an implied valuation of US$10.4B versus the US$1B today, a 10x over 2.5 years.

On the downside, even if we assume that Alphawave loses its project with Amazon and cannot scale into custom silicon (revenues are forever 0), the business will have $110mm in EBIT in 2027 with a bloated expense base and an immature margin profile. Applying a 15x EBIT (conservative for a business growing ~30%+) on that would still be a 1.5x upside from existing day valuations which is a 17% return on the downside.

Risks and Catalysts

There were previously allegations about related party transactions, but these were mainly related to the China business that Alphawave is winding down. I suspect management used most of those relationships as de facto funding sources, but it is less important now. Customers also understand these concerns and the fact they are working with AWE shows that this isn’t an issue:

“I will say that before we engage with a company, we do significant background checks on their leadership, their financials, on their forecast, on the nature of their contracts. It's about a six-to-eight-month process where we want to know not just what we're working on, but who we're working with, what are their values, what are their ethos, things like that.”

– Chief Architect at MSFT

There are also concerns with accounting but that is also largely resolved as many companies on the LSE faces auditing issues due to a lack of experienced auditors last year.

The major structural risk is the inability of the company to produce leading edge IP and technology that is desired by the market. The diligence done so far on the team, the design wins, the products in pipeline, and the caliber of company that are signing up simply show that this risk is low.

The major near-term catalyst is the confirmation of the Amazon product in H2 2024. With the design win, the business will have more legitimacy to sell to other customers and removes a major overhang from existing investor concerns. In the long term, execution and bookings will serve as a natural catalyst for the business to get rerated by the market.

In conclusion, Alphawave is so far the most attractive and asymmetric return profile I have in my portfolio and was one of the few businesses that I got more and more excited the more I learned about the technology and industry.

This is not financial advice and as always, we recommend our readers to do their own diligence.

would love an update

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e