Agora (API) - A Net Net Returning Shareholder Capital

A quick write up as the investment case is simple and largely based on capital market dynamics and less so on business fundamentals. Liquidity is low, which limits this to personal accounts and smaller AUM funds but it should still remain interesting. Liquidity has a reflexive effect as well as share repurchases are limited by exchange rules and API can only purchase 20% of daily volumes which can trade quite thinly.

The basic math is API is currently trading at $270mm market cap while the company has $412mm in cash and investments net of some miniscule long term debt. This is showing a 54% upside simply from capital returns and valuing the core business at zero, this is increased the more shares the company buys back. For example, a full usage of the existing repurchase program at $2.50 would result in a 100% upside.

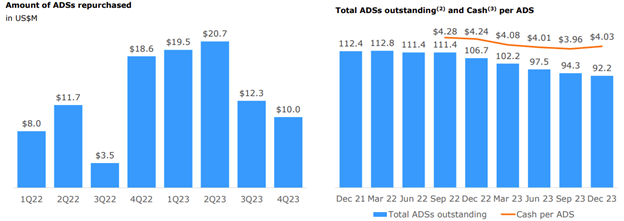

The investments are mainly simple time deposits or other bank products of which a majority is held in Hong Kong and Singapore meaning they’re relatively safe and poses very little impairment risk. The company has a share repurchase program which has repurchased $104 million over the last 2 years and has another ~$100 million remaining in its buyback program which represents 40% of the outstanding market cap.

I would expect the buyback to be renewed in a world where the business is still trading below its cash value and there’s no significant deterioration in the business. As previously mentioned, the main constraint is liquidity as currently only 100-200k shares trade per day which limits buybacks to be 25% of that volume. Looking at the repurchase history, it’s clear that API is maxing out their buyback capacity and is pushing up against these limits. Given last quarter’s trading volume. I expect the business to have repurchased another $9mm shares or 3.3 million shares in Q1 and at this pace to repurchase 15-20% of the business this year, especially if there’s any volatility to drive up volumes.

Net nets go wrong when either (i) you’re stuck with a holding discount because there’s no action to return money to shareholders or (ii) you’re stuck with a company that’s burning all your cash and the business burns all its cash / assets to its market value. Having addressed the fact that the business is trying to return as much capital as possible to shareholders, let’s turn to the business itself.

Agora the business

Agora provides businesses real-time-engagement solutions in the form of APIs. The business focuses primarily on mobile business but also has desktop offerings. The go to market motion is largely product led with advertising geared towards developers and a generous 10,000 minute per month free credits as a way to encourage initial adoption.

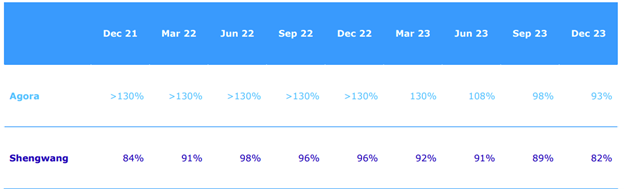

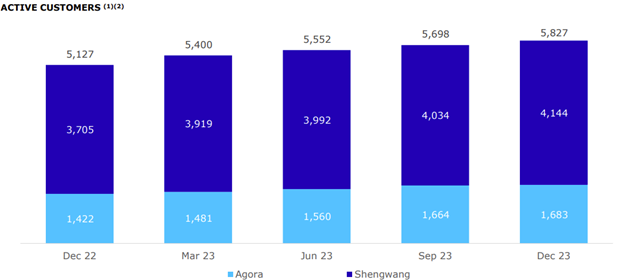

Agora was famously known for helping power Clubhouse, the social network that benefited from COVID hype at the beginning of the pandemic. After the fading of Clubhouse as well as K12 tutoring bans in China, the business has struggled with dollar-based net retention rate slowing drastically in ’23 but has been consistently adding new customers QoQ.

Figure 1: Dollar-Based Net Retention

Figure 2: Active Customers

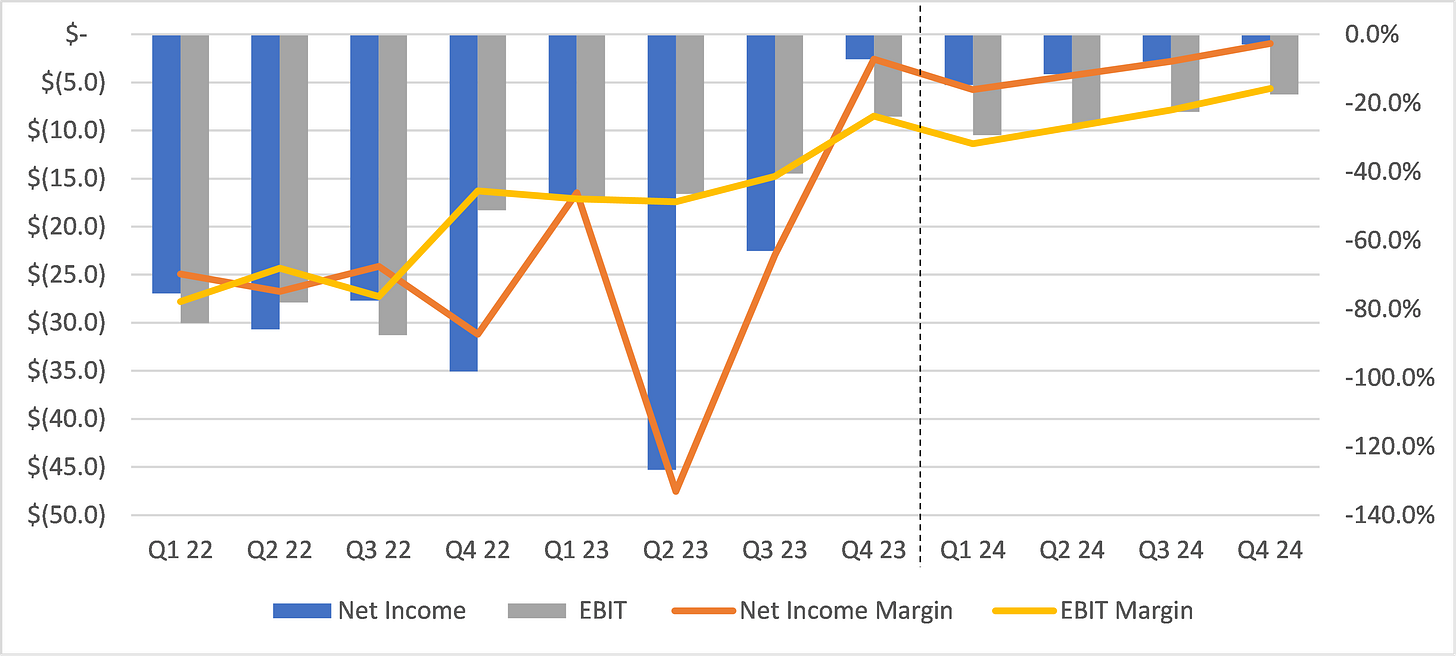

The business has rightsized itself with significant expense cuts and almost reached breakeven in Q4 2023. The company expects now to keep its Q4 expense structure to represent the cost base going forward with future growth to show operating leverage on the expense lines. It’s hard to discern how likely this is but given the valuation I don’t need to underwrite the business to glowing success, just that it can stop burning cash which it has effectively proven in Q4.

Figure 3: Net Income and EBIT Margins

The business growing will be further upside and there is some early evidence of this with the industry rationalizing. Agora’s main competitor Twilio recently exited from programmable video and management has continued to comment that many of its competitors are leaving the industry. The guidance to double digit revenue growth isn’t heroic either. Twilio growth has been in the low-teens in its communications segment. This segment also includes CPaaS offerings which, looking at pure play CPaaS peers such FIVN and EGHT, have been growing at low single digits. Thus, if we assume the CPaaS business has dragged communications revenues, this points to above double-digit revenues for the API comparable piece.

At the double-digit growth range, API would get to a $1mm loss in Q4 24 and on track to profitability with revenue coming in at 60% incrementals. Assuming a 1x revenue multiple (Twilio is trading at ~2x), we can get an additional $140mm (~1.40/share) in value from the Agora business rightsizing itself, or another 56% at current share prices.

As always, we recommend you do your own diligence and we may hold positions in the securities mentioned above.

Congratulations!

Do you think market is bearish on the weak sales G, or something else? I think it's hugely positive news that management is ending unprofitable products. Negatives I see are repurchases are down and debt issuance is up.